Of the five most attention-grabbing, U.S.-based companies, the most innovative company — or most effective at research and development — isn’t the one that’s developing your cell phones, creating your home tech devices or delivering goods to your door.

Rather, it’s one you watch: Netflix.

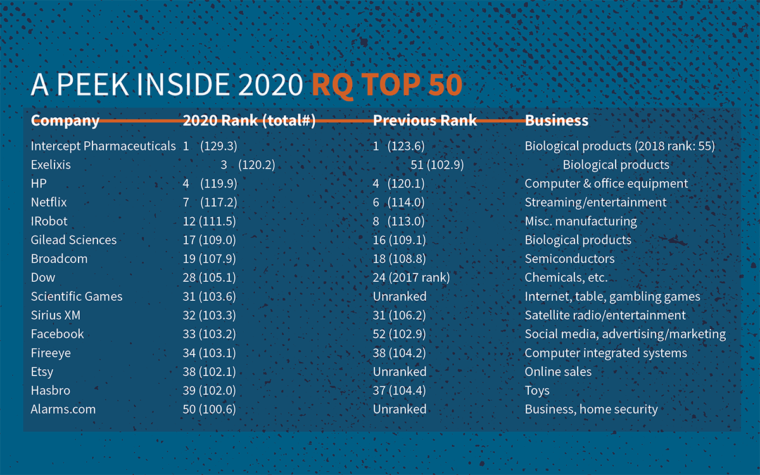

The 2020 RQ50, highlighting the 50 companies whose R&D is most productive, were unveiled Sept. 8 at The Industrial Innovation Path to Economic Recovery Conference hosted virtually by the Boeing Center for Supply Chain Innovation at Washington University in St. Louis.

The unveiling coincides with research forthcoming in the Journal of Financial and Quantitative Analysis, co-authored by Michael J. Cooper of the University of Utah; Wenhao Yang of the Chinese University of Hong Kong, Shenzhen; and the pioneer of the RQ (Research Quotient) measure, Anne Marie Knott, the Robert and Barbara Frick Professor in Business at Washington University’s Olin Business School.

The mid-September conference attendees, in an online audience poll, predicted Amazon would prevail as the most innovative among the FAANG notables: Facebook, Amazon, Apple, Netflix and Alphabet (formerly Google). Then Knott floored the group when she revealed that Netflix was their most innovative by the RQTM measure.

“While Netflix being named to the RQ50 may not surprise anyone — this marks its seventh year in the RQ50 — what may surprise people is that three of the FAANG companies aren’t there,” Knott said.

“People tend to think of these companies as equally innovative, but Apple and Alphabet both dropped out of the RQ50 in 2016, Amazon dropped out in 2017 and Facebook entered for the first time only this year. The decline in Apple, Alphabet and Amazon’s rankings suggest that current growth may be the fruits of past R&D, or that growth is coming from something other than R&D. Declines in RQ typically precede declines in market value,” Knott said.

In addition to unveiling the new RQ50, Knott oversaw a panel discussion at the Boeing Center/Olin conference with two “RQ50 Hall of Famers,” representatives of firms who have been in the RQ50 for 10 or more years: A.N. Sreeram, senior vice president and chief technology officer of Dow (20 years in RQ50); and Clive Meanwell, MD, founder of The Medicines Company (10 years in the RQ50), whose company is no longer eligible for the RQ50 after being acquired by Novartis last year.

Knott noted it was interesting to hear their discussion echo what her RQ research has found: The keys to successful innovation, even in this instance with a 123-year-old company (Dow) and a biotech startup (The Medicines Company), are not all that different.

In their Journal of Financial and Quantitative Analysis paper, Knott and her co-authors examined RQ in a number of innovation tests common to financial literature. First developed by Knott in 2008, RQ can be estimated for any firm reporting R&D. The economic definition for RQ is the “firm-specific output elasticity of R&D.” In other words, it captures a firm’s ability to generate revenue, profits and market value from R&D investment. This distinguishes RQ from patent measures that capture how many inventions a company generates. A company can have a high RQ even when it generates few innovations if it is particularly effective at commercializing them. The higher the better with an RQ, similar to a person’s IQ; a 100 RQ is roughly average.

The co-authors found that RQ “is positively and strongly statistically associated with current and future firm-value measures … [whereas] other common innovation measures are less robust across the three value tests, samples and models.” This is important, because much of the existing research in finance is based on these other measures. The co-authors demonstrated, for at least one paper, that conclusions change when using RQ in lieu of the original measures.

The researchers also noted that another important advantage of RQ over patent-based measures is it allows researchers to examine the 50% of the firms who conduct R&D but don’t patent their innovations.

“Previous studies have treated these non-patenting firms as if they weren’t innovating, which we know is false, because otherwise they wouldn’t be investing in R&D,” Knott said. “This means that in 2005, Exxon-Mobil, Boeing and Altria would all have been treated as non-innovating companies, yet collectively they invested $4 billion in R&D that year.

Comments and respectful dialogue are encouraged, but content will be moderated. Please, no personal attacks, obscenity or profanity, selling of commercial products, or endorsements of political candidates or positions. We reserve the right to remove any inappropriate comments. We also cannot address individual medical concerns or provide medical advice in this forum.