One of the nice things about Occupy Wall Street was that it provided a tidy shorthand to describe the problem of income inequality at a moment when the world didn’t really have one. Today, it’s a cliche: the 99 percent vs. the 1 percent. But at the time, that brief phrase awakened many people to the idea that America’s riches were distributed more unevenly than they thought, and that an increasingly outrageous share was being concentrated at the very top. The winners in this story were corporate executives, business owners, and highly paid professionals—especially bankers. The losers were just about everybody else. Like all shorthand, this tale was a bit oversimplified. But in the wake of a financial crisis brought on by the greed and recklessness of those 1 percenters, it felt apt.

Back then, the people who took issue with framing America’s economy as a tug of war between the ultrarich and the rest of us generally fell into two camps. They were either inequality skeptics, who insisted unconvincingly that research showing the rise of the 1 percent was flawed, or inequality apologists, who argued that letting some people get exorbitantly wealthy was good for the economy, since it rewarded hustle and entrepreneurship (basically, Paul Ryan during his peak makers-vs.-takers period).

Lately, though, a few writers have tried to play down the idea of the 1 percent for a different reason: They say it’s making us miss the real story of class and inequality in America. Last year, a Brookings Institution scholar named Richard Reeves published a book titled Dream Hoarders, in which he argues that America’s upper-middle class is rigging the economy in its own favor. Our national focus on the very rich, he suggests, is blinding us to the reality of how well-off soccer moms and dads in places like Arlington, Virginia, are killing the American dream for everyone but their own kids. “Too often, the rhetoric of inequality points to a ‘top 1 percent’ problem, as if the ‘bottom’ 99 percent is in a similarly dire situation,” he writes. “This obsession with the upper class allows the upper middle class to convince ourselves we are in the same boat as the rest of America; but it is not true.”

Reeves’ book received a brief burst of national attention after David Brooks used it as a launching point for a weird and widely pilloried New York Times column, in which he recounted a story about seeing his friend get flustered by the selection of Italian cold cuts at a sandwich shop. (He assumed this was because she only had a high school education, since you apparently need a philosophy degree to be familiar with soppressata.) But this week, the Atlantic published a long feature more or less rehashing most of Dream Hoarders’ arguments. In “The 9.9 Percent Is the New American Aristocracy,” writer Matthew Stewart argues that aside from a small sliver of true plutocrats who can actually afford to buy an election or two, the top 10 percent of wealthiest Americans are all essentially part of the same highly educated and privileged group—the “meritocratic class”—which has “mastered the old trick of consolidating wealth and passing privilege along at the expense of other people’s children.”

Reeves and Stewart are both attempting to give us a new shorthand for who is ruining the economy. Instead of the 1 percent, they would like us to talk about the dream hoarders, or the 9.9 percent. But in the end, both authors fail by lumping together large groups of Americans who haven’t really benefited equally from our winner-take-all economy. As a result, their stories about how the country has changed, and who has gained, just don’t track.

Reeves and Stewart are both concerned about serious issues in the economy.1 We have a housing crisis thanks to the ridiculously restrictive zoning rules favored by many politically liberal, upper-middle-class homeowners. As a result, the poor and working class are being pushed to the urban fringes and less-resourced suburbs, away from jobs or decent transportation. By closing off their communities, upper-middle-class families are also segregating their public schools by both race and income. Then there’s the college-admissions process, which at elite schools is an expensive circus that favors kids whose parents have money to send them to SAT prep or pay for a French tutor. America favors those with money for lots of reasons, and the upper-middle class is not blameless. They (and I, and maybe you) deserve to be harangued once in a while.

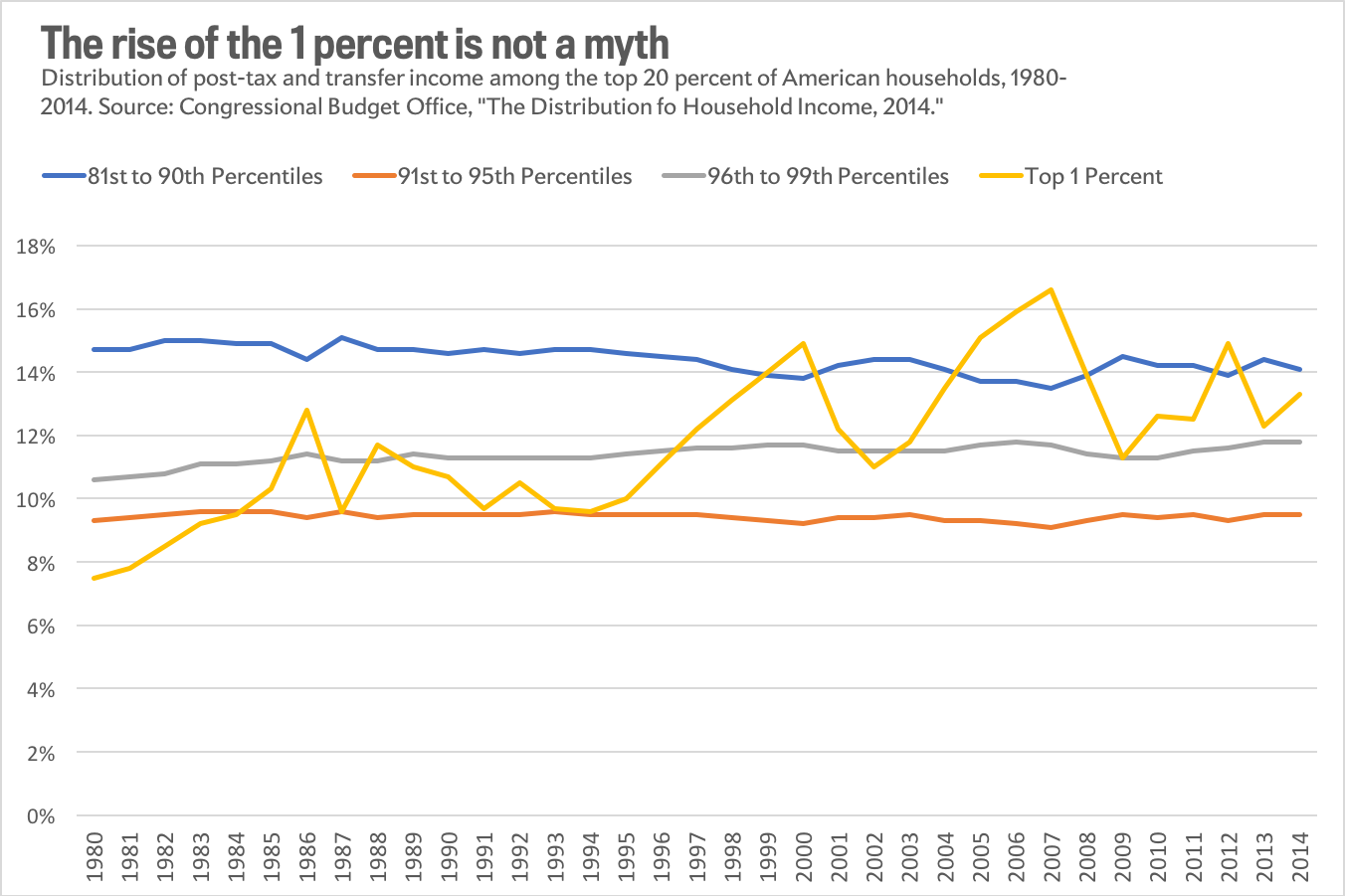

Reeves’ and Stewart’s arguments start to fall apart, however, when they try to explain why we should supposedly pay less attention to the 1 percent. In Dream Hoarders, for instance, Reeves argues that the biggest cleavage in American class is between the top 20 percent of highest-earning households and the bottom 80 percent. “Americans in the top fifth of the income distribution—broadly, households with incomes above the $112,000 mark—are separating from the rest,” he writes. (As of this year, the figure is closer to $121,000.) But even a cursory glance at how America’s income distribution has changed over the past three decades shows why it doesn’t make sense to talk about the whole top 20 percent as a cohesive group or to give short shrift to the rise of the 1 percent. According to the U.S. Congressional Budget Office, the share of after-tax income going to households in the 81st to 90th percentile dropped a bit between 1980 and 2014. The share belonging to the 96th to 99th percentiles rose slightly. And the most dramatic change, by far, has been the rise of the 1 percent.

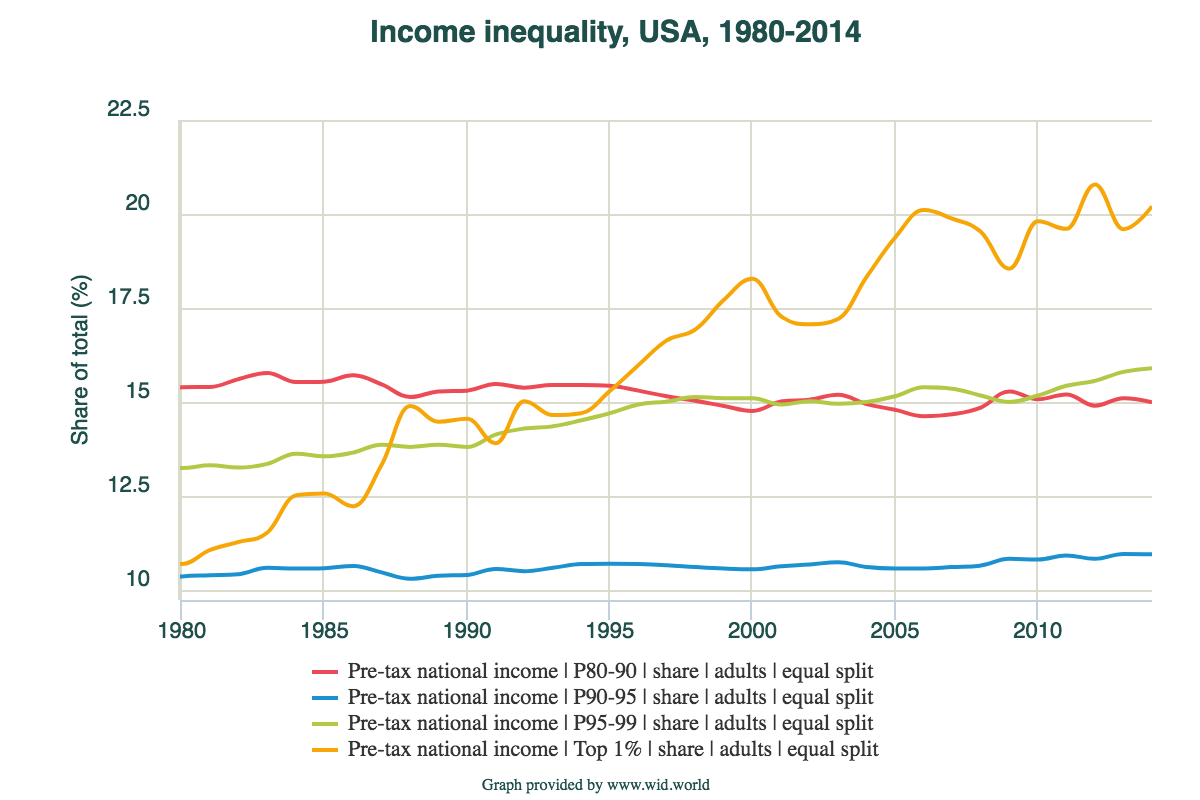

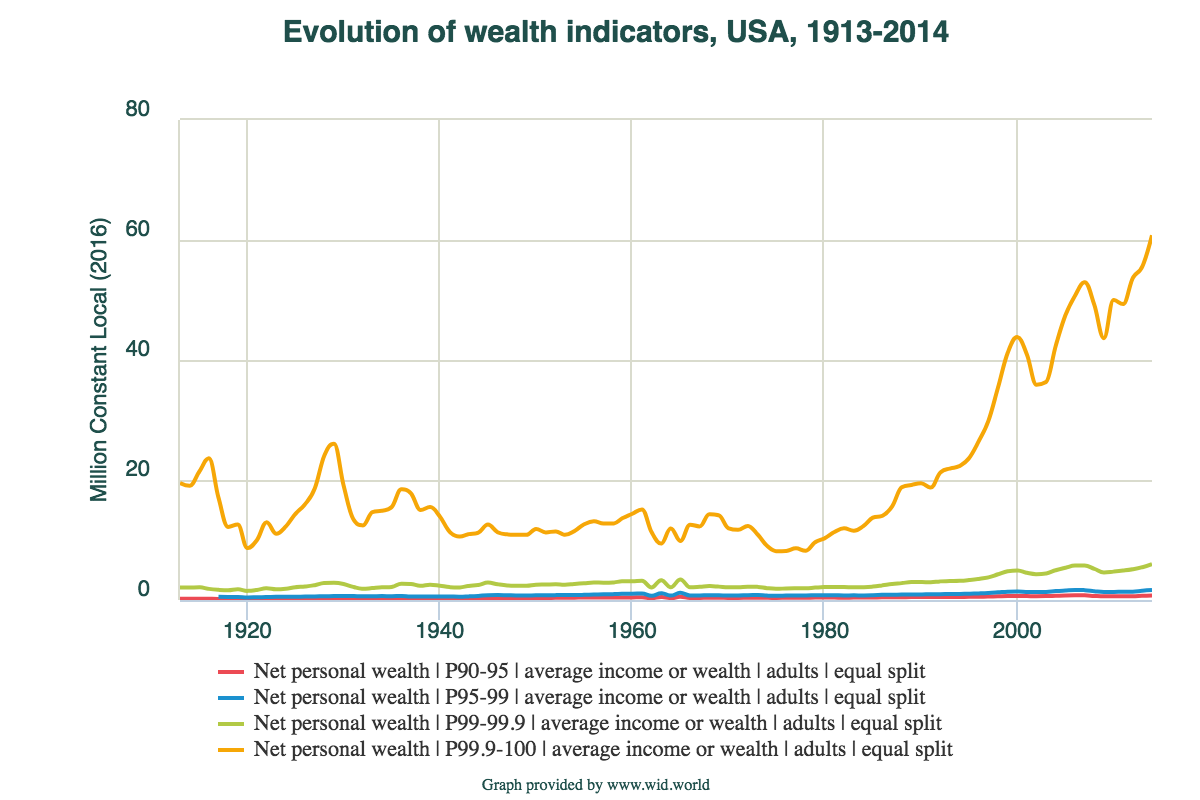

The most recent pre-tax income data from Thomas Piketty, Emmanuel Saez, and Gabriel Zucman tell a similar story. The upper half of the upper-middle class fares slightly better, but the great change is the rise of the 1 percent. It’s hard to miss who is actually pulling away in this graph.

Reeves tries to scoot around these realities in a few ways. He argues that “class is not just about money” and that we need to take into account factors like education, health, parenting styles, marriage, and security—which is all well and good, except those things tend to correlate pretty strongly with having cash. He notes, weakly, that while the top 1 percent increased their total incomes by $1.4 trillion between 1979 and 2013, the next 19 percent of Americans increased theirs by 2.7 trillion. (There are, of course, many, many, many more people in the second group than the first.) Finally, he more or less tells us that 1-percenters are figments of our collective imaginations. “There is another reason why the top 1 percent should not be our primary focus. Far from being some kind of permafrost on top of the income distribution, the top 1 percent is a changeable group. The ‘upper class’ actually consists of an annually revolving cast of families from the rest of the top quintile, according to work by Mark Robert Rank of Washington University in St. Louis,” he writes. “In other words, the top 1 percent is not ‘them’—it’s us, having a good year.”

In some ways, Reeves is just making an intuitive point here: People’s incomes change. A young i-banker pulling down low six figures today will be tomorrow’s managing director with a house in the Hamptons. Law-firm associates become partners, then burn out and go to work for nonprofits. A writer might publish a hit novel, then never do it again. People move up the income ladder. They move down it too.

But Rank’s research—which I’ve written about a few times in the past—also shows that some people have much more staying power at the top than others. Reeves cites the finding that 20 percent of American adults will enjoy a household income of $250,000 or more during at least one year of their life. But he fails to mention that exactly 1 percent of adults earn that much for at least 10 consecutive years during their liftetime. Rank’s findings do suggest the line between the 1 percent and everyone else is a bit thinner than Occupy protesters may have led the world to believe. But they also show how the rich really are different from you and me: They make more money, year after year after year.

Again, Reeves ultimately wants his readers to pay less attention to income concentration at the very top for a well-meaning reason: He’s worried that we’re overlooking behavior of the upper-middle class that is making it harder for children of poorer families to join them. But even there, the data don’t firmly support his concerns. While there’s still lots of debate about the subject, research led by Stanford’s Raj Chetty has shown that relative income mobility—essentially, the likelihood that a child will end up higher on the income ladder than her parents—has been essentially flat for decades. What irrefutably has been changing isn’t people’s ability to move up and down the ladder, but rather the space between the rungs. And that story has much more to do with the rise of the 1 percent than dream hoarding by a poorly defined upper-middle class.

In his Atlantic article, Stewart tries to define his “new aristocracy” using wealth (what people own) rather than income (what they earn). The result makes even less sense than Reeves’ efforts.

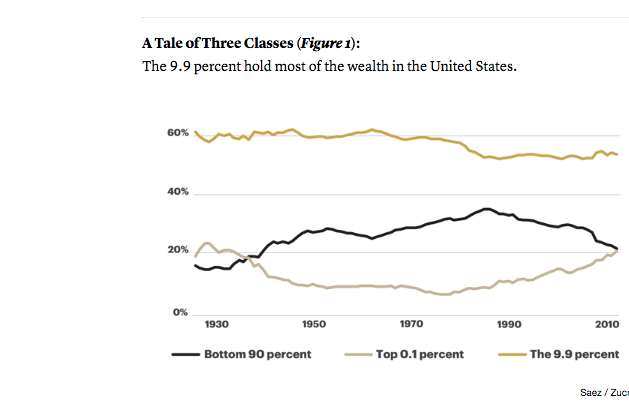

By Stewart’s account, there are really three classes in America. First, there’s the 0.1 percent, the “big winners in the growing concentration of wealth” who have “the kind of money that can buy elections.” Then there’s the bottom 90 percent, who are busy getting screwed by the system. Finally, there are the winners of American meritocracy:

In between the top 0.1 percent and the bottom 90 percent is a group that has been doing just fine. It has held on to its share of a growing pie decade after decade. And as a group, it owns substantially more wealth than do the other two combined. In the tale of three classes (see Figure 1), it is represented by the gold line floating high and steady while the other two duke it out. You’ll find the new aristocracy there. We are the 9.9 percent.

And here’s the graph:

This gold line hovering above the others may look reasonably convincing, but there are problems. First, the 9.9 percent aren’t really who Stewart claims them to be. He describes the cohort (based on what, I don’t know) as “a well-behaved, flannel-suited crowd of lawyers, doctors, dentists, mid-level investment bankers, M.B.A.s with opaque job titles, and assorted other professionals—the kind of people you might invite to dinner.” He neglects to mention that many of them are actually just retirees. According to Saez and Zucman, whose data Stewart uses, more than 40 percent of all wealth belonging to Americans between and 90th and 99th percentiles is held by the the elderly, meaning age 65 or older. This is what makes wealth data a tricky way to measure class below the very tiptop of the distribution. Stewart’s “9.9 percent” includes a lot of working professionals and business owners with gilded academic résumés, sure. But it also probably encompasses a lot of 75-year-old former accountants and nurses and guys with construction businesses who made a comfortable living decades ago, bought a house, and paid down the mortgage while saving for retirement. There’s no real way to tell a consistent story about who these people are, which makes it a bit hard to blame them for the death of opportunity in this country.

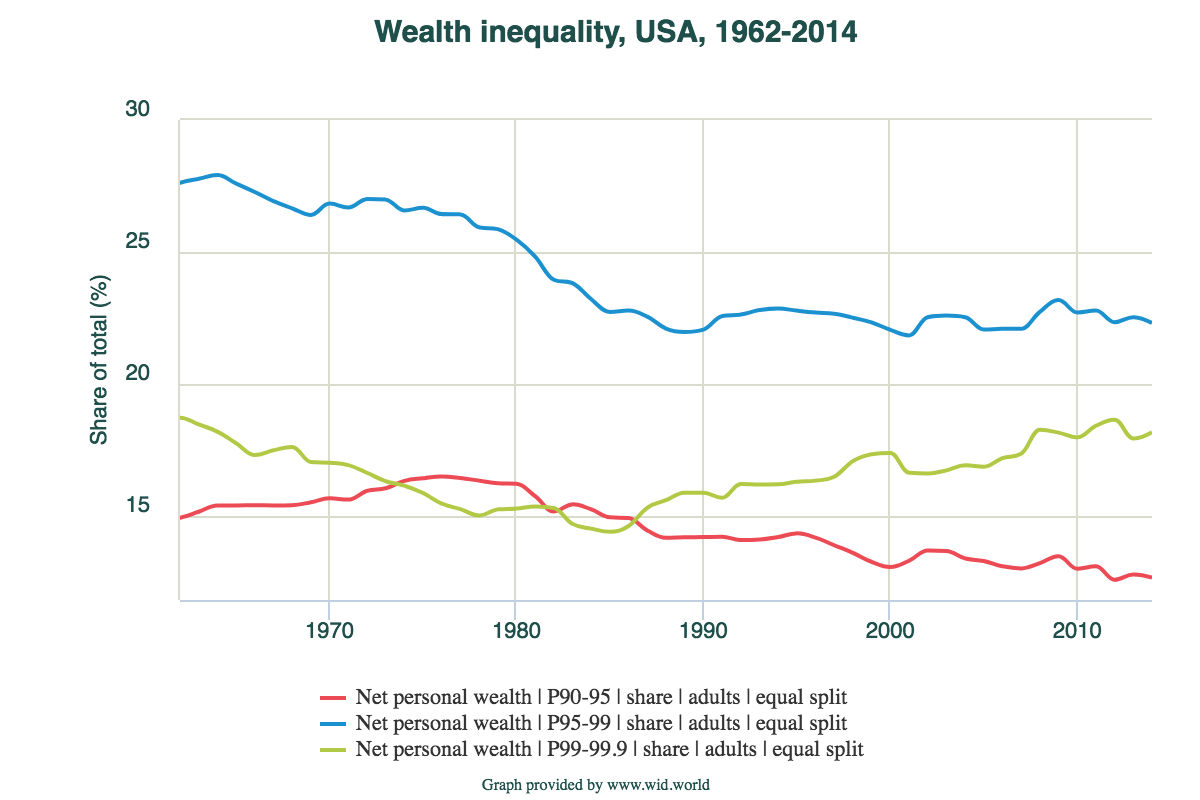

It isn’t even accurate to say that the 9.9 percent has collectively held on to its share of America’s wealth. Here’s what happens when you break the group down into smaller chunks:

It turns out that this “new aristocracy” isn’t a coherent group at all, even if you just look at trends in wealth. Instead, it’s really three groups: one whose share of the pie is shrinking, one whose share is holding steady, and one whose share is growing. Stewart is hiding those differences by blending winners in the post-Reagan economy with some of the losers.

In an age when the likes of Jeff Bezos, the Mercers, and Sheldon Adelson are accumulating dynastic fortunes, it’s also just a bit precious to declare that the new “aristocracy” is made up of people who pay too much for yoga classes and buy their groceries at Whole Foods. The average net worth among adults in the 95th to 99th percentile is about $1.7 million. Among the 0.1 percent, it’s about $60 million. Who, exactly, are the aristocrats again?

It doesn’t help matters that while Stewart claims to be writing an article about, roughly, the top 10 percent of Americans, his article is chock-full of cultural signifiers and complaints that largely apply to people at the much richer end of that range. The corporate lawyers and midlevel investment bankers he references? They’re frequently 1 percenters, as measured by income. He decries how Republicans pared back the estate tax last year, a move that only helped multimillionaires. He focuses relentlessly on the college-admissions gauntlet typical of the top 30 or so most selective institutions. He sheds tears over the fact that Harvard and Princeton admit more than one-quarter of their students from private schools, as if 90th percentilers are the ones sending their children to Andover and Choate. It’s almost as if Stewart has no idea who he’s actually writing about when he needles the “9.9 percent”—which isn’t shocking, since his stats don’t really tell him.

The broader problem with Stewart’s article isn’t his sloppy data analysis, his social reference points, or his awkward use of the phrase aristocracy, however. Rather, it’s how he collapses class distinctions that matter a great deal to people for the sake of a catchy headline. To put it bluntly, a doctor or lawyer who makes $400,000 is a whole hell of a lot richer than a doctor or lawyer who makes $120,000. Those two people are not living the same life, and they’re not necessarily benefiting from the same economic forces.

Stewart and Reeves are right to point out that the American upper class is bigger than just the top 1 percent. There are, indeed, many layers of economic privilege in this country. But they’re doing it in a way that essentially asks us to forget a lot of what we’ve learned about how income and wealth are really concentrating in this country. The 1 percent vs. the 99 percent may not be a perfect shorthand for what ails the economy, but it’s a whole lot more useful than what they’ve offered up.

1 Really Reeves, since I can’t find a single original idea in Stewart’s piece.