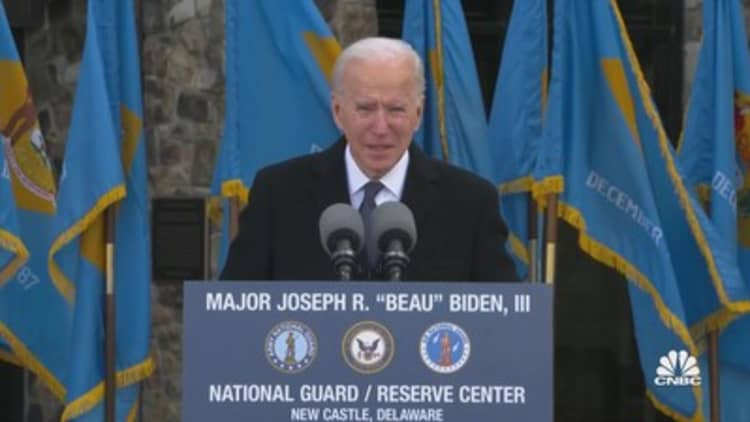

With Joe Biden's inauguration as president of the United States, the country is perhaps closer than ever to a $15 federal minimum wage.

In a speech last week, Biden outlined his $1.9 trillion American Rescue Plan, which will send aid to those hit hardest by the coronavirus pandemic. Under the plan, Biden will call on Congress to raise the federal minimum wage to $15 per hour from the current $7.25. The federal minimum wage has not been increased since 2009.

While boosting the federal minimum wage to $15 is popular among some lawmakers, activists and consumers, it still faces a lot of opposition to becoming law.

More from Invest in You:

Biden pledges to help fix the child-care crisis. Here is his plan

Mother of five's plan to freeze her spending for January

Deepak Chopra: We're experiencing 3 pandemics. How to cope

In 2019, the U.S. House of Representatives passed the Raise the Minimum Wage Act, which would have incrementally increased the hourly wage each year, reaching $15 in 2025. But then-Senate Majority Leader Mitch McConnell, R-Ky., blocked it.

Even though Democrats now have a slim majority in both the House and the Senate, it's not a given that Congress will be able to pass it as proposed, and the $15 wage is a sticking point for a number of lawmakers.

"If the federal government mandates a universal $15 minimum wage, many low-income Americans will lose their current jobs and find fewer job opportunities in the future," said Sen. Pat Toomey, R-Pa., in a Friday statement.

Can a $15 minimum wage be passed via reconciliation?

Democrats could potentially use budget reconciliation, a legislative tool, to pass the bill by a simple majority and avoid a Republican filibuster. Sen. Elizabeth Warren, D-Mass., on Friday seemed to reference using reconciliation to pass a $15 minimum wage.

"If the Republicans want to drag their feet while working families struggle, the Democratic majority should use every legislative tool available to pass it," she tweeted.

To be eligible for reconciliation in the Senate, policies must be tied to the budget and impact outlays and revenue — they can't be incidental. Democrats could potentially argue that a higher federal minimum wage does have a direct effect on the budget, but it's unclear if that will work or if that's the route they will take, said Sarah Binder, a political scientist at George Washington University and the Brookings Institution.

"There's an outside chance you could do it through reconciliation, but I think what I take away from this is, in fact, you need a supermajority and Republican support to get this done," she said.

Democrats could decide to take the $15 minimum wage provision out of any bill they may pass through reconciliation and attempt to pass it as a stand-alone or with other legislation. If they do that, however, they'd need all 50 Senate Democrats to agree on the legislation and votes from at least 10 Republican senators, said Steven Smith, a political science professor at Washington University in St. Louis.

That's unlikely, he said.

"The Senate Republicans are a pretty conservative lot," he said. "Once you get beyond three or four of them, you probably can't find votes for it."

The benefits and costs of $15 minimum wage

Raising the federal minimum wage to $15 an hour over time would boost paychecks and reduce poverty. A recent study from the Congressional Budget Office found that a minimum wage increase to $15 by 2025 would boost paychecks for roughly 27 million American workers and lift 1.3 million out of poverty.

"That's a pretty huge slice of the country to have a better opportunity to spend or save," said Mark Hamrick, senior economic analyst at Bankrate.

The same study also found that 1.3 million people may become jobless because of the impact on businesses, and that teenagers, part-time workers and those with only a high school diploma would be disproportionately affected.

But the CBO's estimates about job losses are more negative than expected, according to Ben Zipperer, an economist at the Economic Policy Institute, a left-leaning research group.

"The benefits of the policy far outweigh the potential costs," he said.

The U.S. population is largely in favor of boosting the minimum wage. A 2019 Pew Research Center survey found that two-thirds of Americans support a raise to $15 an hour. A number of states have already passed laws to make the local minimum wage $15, including California, Connecticut, Illinois, Maryland, Massachusetts, New Jersey and New York.

Florida became the latest state to pass a law upping its minimum wage to $15 during the November election.

The impact on wallets

A higher minimum wage could help the millions of Americans struggling with their finances and begin to level the playing field for those making the least, especially during the coronavirus pandemic, which has been the hardest on the most vulnerable.

"In our society, we unfortunately pay women and people of color disproportionately low wages," Zipperer said. "Raising the minimum wage in the future would bring about the largest wage increases for women and people of color."

Increasing the federal minimum wage would help 25% of Black workers and 19.1% of Hispanic workers, according to an EPI analysis of the Raise the Minimum Wage Act. By comparison, it would affect 13.1% of White workers and 10.8% of Asian workers.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Digital nomad makes $600 a month in passive income: Here are her top tips via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.