Something shocking has happened in the U.S. economy in recent years: average workers have started to move forward.

For decades, only the wealthiest Americans watched their paychecks grow, while the incomes of those at the middle and bottom of the economic ladder stagnated or shrank. The 1980s and 1990s were exceptionally lucrative for the wealthy: families with annual incomes in the top 5% grew at a robust 3% to 4% annually. Meanwhile, families in the bottom 20% saw essentially no income growth. Former President Barack Obama called income inequality, that widening gap between top and bottom wages, “the defining problem of our time.”

The 2008 financial crisis spared no one — income growth dried up for nearly everyone as the economy plunged into the worst recession in nearly a century. But as the U.S. emerged from this disastrous period, something strange happened: Income inequality stopped growing.

A new paper by researchers from Harvard and MIT revealed that in the years leading up to the COVID-19 pandemic, rising incomes at the bottom of the economic ladder caused income inequality to decline for the first time in about 30 years. By 2012, low-wage workers were finally seeing real, sustained wage increases. In early 2019, annual wage growth in the working class even exceeded overall wage growth.

While the initial pandemic-related shutdowns increased unemployment, the economic pain was relatively short-lived: the combination of government stimulus programs and a strong recovery in consumer demand led to a rapid recovery in the labor market. Shut down businesses soon began putting up “Help Wanted” signs, workers quit their jobs for higher-paying positions as part of the Great Resignation, and thousands of underpaid employees demanded better conditions during the “Striketober.” This radical shift in the labor market meant workers had more power and incomes recovered quickly – people in the bottom half of the economic scale saw their incomes return to pre-pandemic levels in less than two years.

This burst of workers’ power not only reversed a decade-long trend of wage inequality, but also gave workers the power to demand better working conditions. For the past two years, workers have refused to return to the office and have begun to organize for more solid profits.

But that moment in the sun for the average American worker is fading fast. Persistently high inflation and rising risk of recession are likely to wipe out the worker-friendly economy. And fears of layoffs are already affecting workers’ ability to seek better alternatives. As workers brace themselves for turmoil, it’s worth taking stock of whether the Great Resignation had a lasting impact — or if it was just a brief pit stop on the longer road to an even more unequal society.

A tight job market is good for workers

The main reason for this gain in workers’ power was the tight labor market. In a tight labor market, companies want to hire more workers than are readily available — it is characterized by many vacancies, low unemployment and fierce competition for labour. A tight labor market also means that companies have to offer higher wages to attract new employees or encourage people to change jobs. This helps push incomes up, especially for those at the bottom of the income distribution ladder.

The clearest sign of a tight labor market is a low unemployment rate. In 2009, U.S. unemployment peaked at 10% — but the steady decline from 2012 onwards meant the job market was tightening, which helped boost wages for working Americans. By 2018, the unemployment rate was below 4% — the lowest level in almost two decades. After rising in the early months of the pandemic, it fell steadily before bottoming out at 3.5% last summer.

These historically low interest rates provided the basis for workers to demand more money — either by threatening to leave if they didn’t get a raise or by quitting for better-paying jobs. This shift is especially important in industries like retail, fast food, and nursing, where advancement opportunities are limited and a bigger paycheck often means finding another job. In recent years, low-wage companies like Target, McDonald’s, Walmart, and CVS have announced significant pay rises to retain existing workers and attract new ones. And those moves have forced other companies to adjust their wages to stay competitive, raising wages for millions of struggling workers thanks to the hot labor market.

As more workers quit for better-paying jobs, wages rose. By 2021, wage growth for low earners far outpaced growth at the top. And by fall 2021, wage growth in the bottom quartile of the labor market outpaced inflation, bringing some relief to those workers as they faced rising costs for food, shelter, transportation and other essentials.

The tight labor market has also helped many workers organize — it’s easier to fight for better conditions if you’re not constantly concerned about job security. The number of petitions related to union elections has increased by almost 60% in 2022 compared to 2021. Since last year, over 200 Starbucks, the first Trader Joe’s, a giant Amazon warehouse and even medieval reenactors have voted to unionize in their workplaces. Unions help raise wages by allowing workers to bargain with their bosses for more money. And union influence extends beyond the benefits of collective bargaining: the mere threat of a union can compel employers to pre-emptively comply with workers’ demands. It is no coincidence that during this unprecedented campaign of organizing at its plants, Starbucks management has increased wages and benefits at its remaining non-union stores. And the legendary coffee maker isn’t the only big-name company raising wages amid rising unrest among workers. After a handful of its stores voted for the union in spring 2022, Apple announced an across-the-board pay rise for its retail workers.

What will the Great Resignation gain for the workers?

Falling unemployment, higher wages and strengthening unions helped suggest there was some hope that the bleak long-term outlook for income inequality could be reversed. But now that the Federal Reserve’s efforts to curb inflation all but guarantee that the good times for job-hopping workers are about to end, the sustainability of this shift is in the stars.

There are already signs that employee profits are beginning to fade. Many employers delay or even refuse to negotiate through union contacts — the primary means by which unions improve working conditions and pay their members. A union contract can ensure that gains made in tight labor markets endure even when they relax. So, without a contract to secure economic gains, workers may have won a number of battles, but they risk losing the long-term war.

Likewise, many of the wage increases that workers have fought for in recent years are not indexed to inflation, and rising prices could quickly erode the value of those efforts. Wage floors that automatically adjust for inflation would help secure wage increases for low-wage workers — but without union deals or more movement from state legislatures, workers risk losing money every time the economy collapses.

How to make the gains permanent

All hope is not lost; There are some big resignation gains that could remain. Half a dozen states have passed paid sick leave legislation since the pandemic hit, giving millions of workers access to a vital benefit for the first time. And recently, policymakers in some states and cities have enacted “pay band” laws that encourage pay transparency by requiring employers to include a pay band with all job postings. While we await research into their effectiveness, these laws have the potential to empower workers by directing them to higher-paying positions elsewhere. But on the face of it, the lasting impact of this unprecedented period of workers’ bargaining power appears minimal.

“But when the period of low unemployment and rising workers’ power ends, without further legal support, workers’ bargaining chips are likely to disappear with it.”

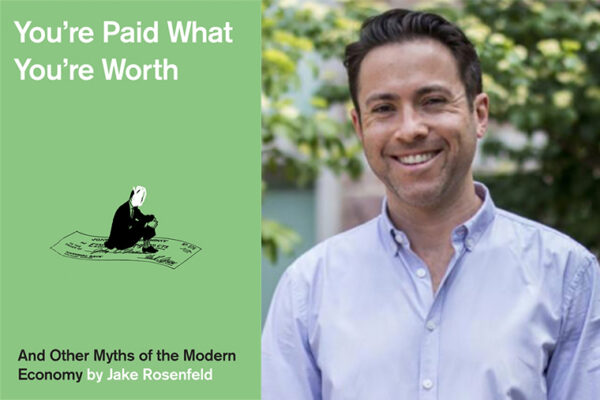

Jake Rosenfeld

That doesn’t mean this shift is set in stone. There are clear ways that workers can maintain the momentum of recent years even as the labor market weakens. For its part, the Fed should aim to keep interest rates as low as possible in order to achieve its goals of slowing the economy and containing prices. This could avoid triggering a recession and high unemployment. Meanwhile, lawmakers can stem the pain of rising unemployment by cracking down on non-compete and non-solicitation clauses in employee contracts to encourage competition for workers. Non-compete clauses prevent workers from moving to a competitor for a period of time and deter workers from seeking better opportunities in their chosen field, resulting in lower wages. Non-solicitation agreements prevent employers from hiring at competing firms in the same industry. Both practices undermine workers’ power by reducing their bargaining chip.

Updating our antiquated labor laws would also help workers make lasting gains, or at least Congress could adequately fund the National Labor Relations Board — the body responsible for making sure companies comply with current labor laws. Despite a rising caseload, the number of regional NLRB employees has fallen by more than a third since 2010, making it more difficult for the board to hold companies accountable for worker abuse.

We have endured a remarkable period of rock-bottom unemployment, which has helped boost wage increases for many of our most important and lowest-paid workers: those who stock our grocery shelves, care for our aging relatives, process our groceries, transport our goods and deliver. These gains helped reverse what many of us thought was an enduring feature of the modern U.S. economy: rising income inequality. But when the period of low unemployment and rising workers’ power ends, without further legal support, workers’ bargaining chips are likely to disappear with it.

Jake Rosenfeld is a professor of sociology in Arts & Sciences at Washington University in St. Louis and the author of “You’re Paid What You’re Worth and Other Myths of the Modern Economy.”

Source: This story originally ran on BusinessInsider.com.