Competence, confidence affect whether investor ‘sharks’ bite

An Olin Business School faculty member teamed up with three researchers from Michigan State University to examine investors’ decision-making, and they came up with a novel idea for a laboratory: ABC’s reality TV show “Shark Tank.”

New theoretical model links loans to bank’s capital on hand

A Washington University in St. Louis finance and regulations scientist has published a paper with a theoretical model that basically proposes bridging the divide between bankers and politicians to link such capital requirements to something of a political football: credit allocation — a bank’s business of financing loans.

Research on the wisdom of crowds: Making the bandwagon better

Before customers jump on the bandwagon of online crowd information and buy a dinner, a book, or a movie ticket, suppose there were a way to make the bandwagon better? That’s the central question behind “Harnessing the Wisdom of Crowds,” a research paper co-authored by Washington University in St. Louis’ Xing Huang and published in the journal Management Science.

Stock analysts accentuate the negative so firms can achieve more positives, study finds

A new study involving two Olin Business School researchers finds that analysts disseminate earnings news by revising share-price targets or stating they expect firms to beat earnings estimates, often tempering such information — even suppressing positive news — to facilitate beatable projections.

Study: Passive investors facilitate activists’ ability to be aggressive

A new study led in part by Olin Business School’s Todd Gormley finds that increasing numbers of passive investors is encouraging activism targeted at board makeup changes, proxy settlements and the sale of the business or its parts.

Banner days for women in Olin’s MBA

Schoolwide efforts are among the threads weaved into the fabric of an Olin Business School MBA program ranked No. 4 in the world for women, according to a Financial Times analysis — placing it behind only Stanford and the University of California, Berkeley among U.S. universities, and China’s Shanghai Jiao Tong, but just ahead of Harvard.

Zhang named Yangtze River Scholar

For the third time in four years, a Washington University in St. Louis faculty member has received the highest award that the People’s Republic of China bestows on an individual in higher education. Fuqiang Zhang,of Olin Business School, has been selected to receive the Yangtze River Scholar Award.

Computer-simulated soybeans

Where machine learning meets spring planting and big data intersects with farming big and small, two Olin Business School researchers have devised a computational model so farmers and seedmakers could take the guesswork out of which particular variety of, say, soybean to plant each year.

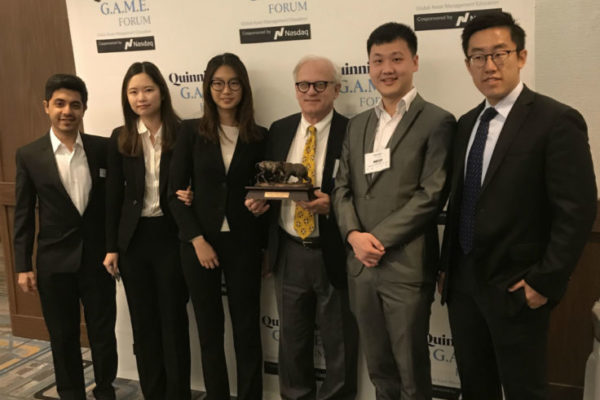

Olin students tops in Quinnipiac finance competition

Five Olin Business School students showed off their financial savvy and took first place in the “value investing” division of the prestigious Quinnipiac G.A.M.E. Forum last month in New York.

Insolvency, not liquidity, is the problem

Reviewing empirical and theoretical papers in the aftermath of the 2007-09 financial crisis, Olin Business School finance expert Anjan Thakor cites a twofold finding from his study. First, U.S. and European banks need to understand that insolvency was the issue that rocked the world, not liquidity; and second, the current standards for bank capital are all wrong and require adjustment.

Older Stories