American households making less than $50,000 are more likely than higher-earning families to spend the expanded child tax credit on essential expenses and tutors for their children, found a survey from the Social Policy Institute (SPI) at Washington University in St. Louis.

Families are using the money from the credit in a variety of ways, depending on household income and job circumstance, the survey found.

“Even before the pandemic, low- and middle-income U.S. families faced three fundamental challenges: tight budget constraints, difficulty even saving small amounts for emergencies and large debt burdens,” said Stephen Roll, research assistant professor at the Brown School and SPI and co-author of the paper “Employment, Financial and Well-being Effects of the 2021 Expanded Child Tax Credit.”

The early evidence is that the child tax credit (CTC) is helping families solve these challenges,” Roll said. “They are planning to use the CTC payments to build up their often anemic emergency savings accounts, pay for essentials for their families and children and catch up on their expenses.”

The expanded child tax credit provides families with $3,600 for every child in the household under the age of 6, and $3,000 for every child between the ages of 6 and 17. Almost all middle- and low-income families with children are eligible for the credit.

To understand how families were responding to the CTC, Roll and his co-authors utilized a probability-based online panel to survey a nationally representative group of 1,514 American parents eligible for the credit. The survey was administered July 8-13, 2021 — immediately before the first such payments were delivered.

“What’s interesting is that the CTC payments also may give families across the income spectrum the financial slack to help invest in their children’s future as well as their present,” Roll said. “For example, we see high percentages of low- and middle-income families saying they will use the CTC to build a college fund for their children, and pay for their extracurricular activities.”

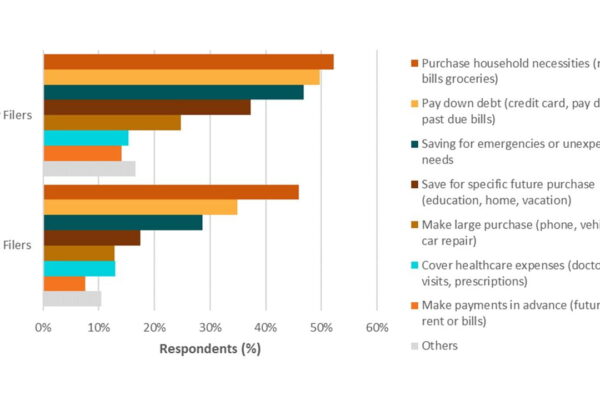

When asked what parents intended to do with the credit, the most common responses were:

- save for emergencies (74.8%)

- apply the money towards housing, food, and utilities (66.6%)

- purchase clothing or other essentials for their child(ren) (58.1%)

- purchase more or better quality foods for their family (49.0%)

- contribute to a college fund for their child(ren) (41.9%)

“It is important to remember that child poverty does not just affect childhoods,” Roll said. “If a child experiences poverty, that affects their long-term earnings, their health, their educational attainment and many other things. The CTC appears to be addressing this issue, both by directly reducing poverty and encouraging more investment from parents to their children.”

Roll’s co-authors on the study are Leah Hamilton of Appalachian State University; Mathieu Despard of University of North Carolina, Greensboro; Elaine Maag of the Urban Institute and Yung Chun of the SPI.