The U.S. Senate, with significant prodding from the Trump administration, Cabinet and Congress, pulled back the curtain late March 19 on a plan to directly provide cash assistance to millions of Americans amid the economic fallout from the COVID-19 pandemic.

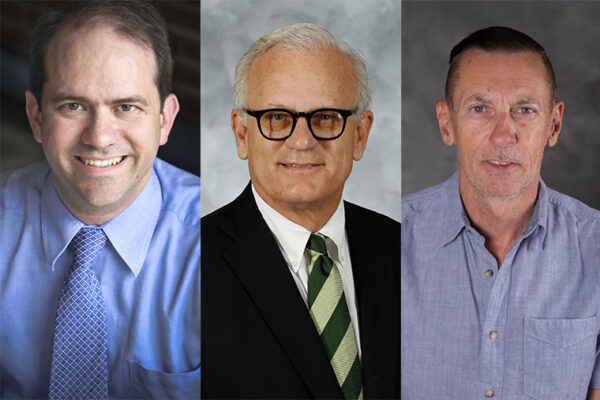

While the Senate plan mentions a one-time payment, compared to the two payments advocated by President Donald Trump and Secretary of the Treasury Steven Mnuchin, experts in economics and finance from Washington University in St. Louis’ Olin Business School weigh in on how it could help housing and households and maybe pay some bills — but still not answer the problems at hand.

“There is no overall economic benefit, although there might be political advantages,” economist Glenn MacDonald said. The federal government should “attack the problem instead of engaging in pointless and ineffective attempts to ‘do something.'”

‘There is no net stimulus’

“There’s the old saying: ‘There is a problem, so something must be done. X is something. Therefore, X must be done.’ That is, we often do something pointless just to make it seem like we are doing something.

“This is what the consumer stimulus checks do. Every penny of those checks must be paid for by someone, either through current taxes or future taxes to pay for the borrowing needed to fund the checks. Taxpayers know these checks make them poorer, so they lower their spending in various ways. There is no net stimulus, although there is a transfer of resources from taxpayers to those who receive the checks.

“The same applies to business bailouts, low-interest loans etc. It’s a fact we have a problem at the moment, and many of us are going to feel the effects of that, whether it be directly through being ill, or less directly by having to work less or differently. Checks from the government will help some of those who feel those effects, but at the expense of others. There is no overall economic benefit, although there might be political advantages.

“The only way for the government to stimulate the economy is by doing something that creates new economic value, or reduces wasted value, not just rearranging the value we already have. This is why the government’s attention should be solely directed toward funding serious attempts to develop vaccines, streamlining approval processes, developing ways to protect health-care workers, expanding short-term hospital capacity,… That is, attack the problem instead of engaging in pointless and ineffective attempts to ‘do something.'”

This is all for housing, household credit

“In my view, these payments are an essential part of making sure the system does not collapse. I also believe that they will work slightly differently from usual.

“Usually, when the government mails checks to households, especially those in the lower end of the wealth and income spectrum, it is to encourage consumption. Low-income households tend to have higher marginal propensities to consume from sudden windfalls. Such consumption in turn will add to economic growth.

“In the current instance, I don’t believe households will necessarily go out and consume from the money they get. On the other hand, these payments will enable households, especially those whose members have lost their jobs, to not default on their rental, debt and other fixed obligations. This in turn would prevent wholesale damage to household credit profiles. This will enable a quick bounce back in consumption and economic growth once the virus’ grip loosens. Thus, these checks will prevent the crisis from having a long-term negative effect on economic growth through the household leverage channel.”

— Radha Gopalan, professor of finance and academic director of the IIT-Bombay-Washington University Executive MBA Program

How will that money be spent?

“The problem with the stimulus checks of straight cash is that people are being ‘prevented’ from going out and spending it. We are a consumer-focused economy, at 70% of all GDP. That includes big durables (which are probably not going to be stimulated by a potential $2,400 windfall over two months), plus lots of services (like restaurant meals, and day care, and haircuts, and dry cleaning, and …). Retailers are closing, and even Amazon is limiting deliveries to essentials. So where are we going to spend that money?

“Most theories of helicopter money assume that there is a lot of aggregate supply in the economy, but we don’t have sufficient aggregate demand — or, we have the willingness to pay, but not the ability. Right now, we’re being hit with a double-whammy of a drop in aggregate demand and a drop in aggregate supply.

“Services are 45% of GDP, which is a big portion of the economy. Social distancing also limits services to those that can be delivered remotely, but haircuts and handyman repairs and dry cleaning and lots of other small business services aren’t virtual.

“The one area it would help is it could be used to pay bills like rent or utilities that could lead to eviction or services being cut off (for those who are unemployed). But this isn’t going to generate incremental GDP multiplier effects.

“We can’t think of this as a typical downturn, and therefore can’t use typical stimulus effects. We need to think more critically about which expenses are going to push individuals — and small- to mid-size enterprise businesses — into bankruptcy, and think about how to support (or defer) those payments directly. The efforts by the Fed will help big businesses who can tap into debt and equity markets, but they don’t help the small businesses and individuals.”

— John Horn, professor of practice in economics

WashU Response to COVID-19

Visit coronavirus.wustl.edu for the latest information about WashU updates and policies. See all stories related to COVID-19.