The U.S. economy felt shock waves the second week of March from reactions related to the global outbreak of novel coronavirus, also known as COVID-19, hitting the nation almost coast to coast. Store shelves were empty of disinfectant products. Travel plans were abruptly canceled or delayed. Schools, universities and businesses were closed. Families were quarantined. And trading on Wall Street was forced into its first break or “timeout” in decades March 9 because it fell by the trigger 7%… then again a week later before it plummeted nearly another 13%.

Takin such a break is a mistake, according to one Washington University in St. Louis expert, Radha Gopalan. He along with eight other Olin Business School academicians and researchers offer perspectives on the economic, financial and everyday business reactions to the viral outbreak:

The markets

“The 15-minute break is not useful. There is no reason to think the market was overreacting in the morning of March 9. The market had all weekend to process the news and was reacting to it.

“I don’t think a complete shutdown is in the cards. Nothing needs to be done. As far as I can see, the market is functioning as it should.

“Oil and virus are factors [in the March 9 markets plunge]. In the case of oil, its effect is compounded by the leverage that many of the shale companies are under. In the case of the virus, it is more the uncertainty that is damaging the market. Even if firms make zero profits this year, that should not impact the market as much as it has. So it is a combination of lower profits and increased uncertainty.

“Several companies can and will declare bankruptcy in the next few months. … We can expect a fiscal stimulus package soon. Both households and firms will need help.”

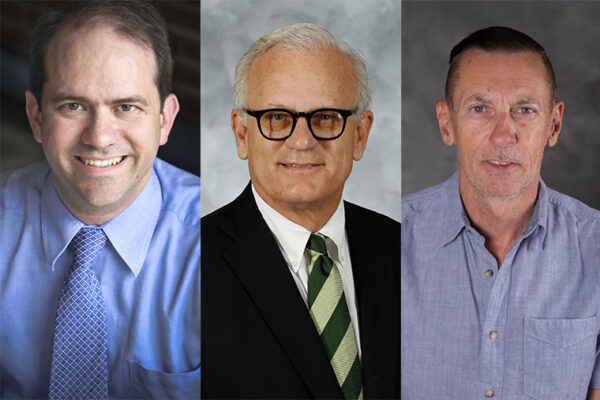

Radha Gopalan

“The spillover due to leverage is something that has not yet played out fully. Several companies can and will declare bankruptcy in the next few months. This is because the junk bond market was going gangbusters until the current crisis hit. That means there are several firms with very little cash flow cushion. So if the virus results in even a small fall in their cash flows they will have difficulty servicing their debt. The credit market for junk bonds is also frozen, and I don’t think new financing is going to be available anytime soon. This may also spillover to banks and other financial institutions.”

— Radha Gopalan, professor of finance and academic director of the IIT-Bombay-Washington University Executive MBA Program

“[The market break] was a nonissue, and for now the markets appear to be working fine.

“The fundamental news is just terrible. … What I think is being missed is that the probability of an economic disaster has gone up considerably and is expected to stay elevated for a while.

“In Manela-Moreira (2017) we studied a long history of such events and found that when disaster concerns are elevated, stock market prices fall because average returns going forward must be high enough to compensate for the higher probability of a disaster. If the disaster materializes (e.g. a highly lethal pandemic), stock market investors will likely lose more. But in the more likely scenarios (e.g. a moderate epidemic), stock market investors would gain high returns for bearing this risk. Our work also shows that much of the risk is about government policy-related uncertainty, so some of the drop in stock market prices may have to do with how the investing public is perceiving the response by policymakers to the virus threat.”

— Asaf Manela, associate professor of finance

Overall impact: More Federal Reserve cuts or stimulus coming?

“Because significant epidemics are rare, and mostly do not occur in developed countries, estimating the economic impact of epidemics on the U.S. is difficult. There are two main sources of impact. One is the direct effect within the affected economy. This effect can be significant in the sense of declines in GDP. Estimates of the impact of the recent West Africa Ebola vary widely, but a 10% short-term GDP decrease would be in the right ballpark. The other impact is indirect and through the effect on trading partners, travel to affected areas, etc. These estimates also vary widely, but tend to be much smaller than the direct effects.

“Unless the coronavirus becomes much more lethal … it seems unlikely that its economic impact on the U.S. will be more significant than that of swine flu, SARS or a bad flu season.”

Glenn MacDonald

“For example, research by Bambery et. al., in Health Security, February 2018, provides an example in which an Ebola-like disease spreads though India, China and seven other Asian countries, and concludes that the impact on U.S. economic activity would be measured in hundreds of millions of dollars, not billions; for comparison, U.S. GDP is about $20 trillion. Unless the coronavirus becomes much more lethal with the passage of time or seasons, it seems unlikely that its economic impact on the U.S. will be more significant than that of swine flu, SARS or a bad flu season, i.e., minimal.

“The newly released McKinsey study, COVID-19: An updated perspective on the implications for business, studies several scenarios, the most extreme of which leaves the U.S. economy still growing during 2020; in more plausible scenarios the economy experiences a slight reduction in growth.”

— Glenn MacDonald, the John M. Olin Distinguished Professor of Economics and Strategy

Gopalan: “In my view, the Fed rate cut will prove not very useful, and we can expect a fiscal stimulus package soon. Both households and firms will need help. Many firms do not grant paid sick leave, and so if there is prolonged quarantine then households will need help. It is also clear that small and medium firms that have limited cash flow cushion also will need help. Other countries such as China, Japan and Germany are already doing this, so I think it is just a question of time before the U.S. government follows suit.”

Empty store shelves and supply chain

“Companies have always been conducting business facing uncertainties from the demand side and the supply side. Many companies have developed operational flexibility to quickly respond to changes in the marketplace. Strong demand for disinfectants and hand sanitizers will trigger quick changes in resource allocation — raw materials, workforce, production capacity, transportation — to those product categories and support the production ramp-up to meet the market demand. How long it will take before the shelves are filled up again depends on the responsiveness of the entire supply chain, from raw material suppliers to logistics partners.

“Assuring the public of the sustained supply of those goods can be important to help ease the consumers’ panic purchase and prevent unnecessary shortages.”

— Lingxiu Dong, professor of operations & manufacturing management

Gig economy work

MacDonald: “The gig economy consists primarily of individuals who fall into two groups. For some, e.g., freelance writers, doing gigs is how they have chosen to organize their career on a more or less permanent basis. They value the freedom to organize their own schedules, work for a variety of businesses, and they generally have a plan for the various benefits that might otherwise be provided by an employer, e.g., health insurance that is purchased from a private insurer or the ACA. For them, gigging is a professional activity. The other group comprises individuals who gig because the economy is weak and finding other employment is more challenging. These individuals tend to see gigging as a short-term way to manage cash flow and are much less organized with respect to retirement savings, health insurance, etc. Due to the strong economy, this group is comparatively small at the moment. But in terms of access to health care, this group will feel a much greater impact if they fall ill.”

“The effect will likely vary, based on the type of platform that gig workers are using. It seems likely that ride sharing and home sharing services will be hard hit by business shutdowns. There will be fewer airport rides for Uber and Lyft drivers, and there will be fewer travelers using Airbnb. Other gig economy platforms may see an increase in demand. Postmates, Shipt and other grocery delivery services may increase in popularity if customers wish to engage in ‘social distancing’ by avoiding the grocery store. These platforms are already providing a ‘contactless’ delivery option. Platforms like Upwork, which allow workers with computer skills to find short term gigs, might also see more demand. To the extent that businesses are already coordinating with remote employees due to the coronavirus, businesses might also be more willing to experiment with remote gig workers as well.”

— Seth Carnahan, associate professor of strategy

Facts, brands and how U.S. big businesses send signals

“One observation I have had relates to how companies are enacting, revising and communicating their relevant policies to consumers in response to COVID-19. For example, I have received multiple emails in the past day from airline companies explaining their existing or revised flight refund policies in response to COVID, and emphasizing that these policies are in place because they care about their customers.

“A clear pattern emerging from the prosocial behavior literature is that people only give credit to others for being ‘nice’ if they believe those others, including companies, were being nice because they were authentically motivated to be nice, and not just because those others were trying to protect their reputation. So, consumers are very likely paying attention to cues from these corporate messages that signal whether the company truly cares about their customers, or, whether they are just being nice for reputation’s sake.”

— Cynthia Cryder, associate professor of marketing

“Consumers are very likely paying attention to cues from these corporate messages that signal whether the company truly cares about their customers, or, whether they are just being nice for reputation’s sake.”

Cynthia Cryder

PR firm 5W Public Relations surveyed hundreds of U.S. beer drinkers and discovered 38% would not buy Corona beer as a result of the outbreak of the virus named for the crown-like spikes on its surface. Some 16% of those survey respondents were confused about the beer’s association with the virus (none).

“Research has looked at how product recalls have affected non-recalled products. I think the basic gist is that non-recalled products with similar names to recalled products usually experience dips in sales. That suggests that customers are only somewhat aware of which brand had a problem and may avoid a wider range of products out of precaution. This may even be rational for consumers if one considers the cost of looking into facts. While it might seem silly to connect Corona beer and the Coronavirus to an informed person, understanding what the Coronavirus is and how it is spread requires reading up about the illness. However, people have limited time to research about the world, and we all make assumptions to fill in our missing knowledge. No doubt, many of those missing assumptions are wrong, but the cost of always having the correct facts is also very high.”

— Raphael Thomadsen, associate professor of marketing

What should U.S. businesses do: shut down, work remotely …?

“Organizations must take whatever actions are necessary to avoid placing their employees in a position where they are at greater risk of exposure or infection. Remote work is certainly one way of accomplishing that, although it will not be possible for every organization. Threats to a company’s supply chain and workforce may make it difficult to meet customer expectations. If organizations are unable to meet some commitment or expectation because of safety measures, they need to communicate that clearly as early as possible and, where possible, make alternative accommodations or arrange for some way of compensating customers for inconvenience.”

— Stuart Bunderson, the George & Carol Bauer Professor of Organization Ethics and Governance

“One thing I would encourage organizations to consider is whether COVID-19 provides opportunities to learn new capabilities that would not exist in their organization otherwise. For example, at a university or a school system, the ability to deliver remote learning effectively is often not a core competency. I know this is something that we wrestle with at Washington University, and something top of mind for many K-12 systems as well. That said, if organizations are forced to develop and test this capability at scale in times of crisis, it could also be used in more normal times. Distributed work is another example of this kind of behavior. While there are some organizations — Automattic, for example — that have built entire business models around remote work, most people work in a similar way to how they worked 50 years ago: going into the office, meetings in person and flying to visit clients. One of the potential unintended consequences of having to deal with disruption is the learning of new behaviors — in this case, the possibility of learning how to function with employees working from home and with less significant air travel. For many organizations, I would encourage them to consider ways in which this kind of radical disruption might provide learning opportunities that exist long after the most significant thrust of the virus has passed.”

— Peter Boumgarden, professor of practice in strategy and organizations

WashU Response to COVID-19

Visit coronavirus.wustl.edu for the latest information about WashU updates and policies. See all stories related to COVID-19.